Raise Your Trading Game on the Wowbit Trading Market Exchange System

Wiki Article

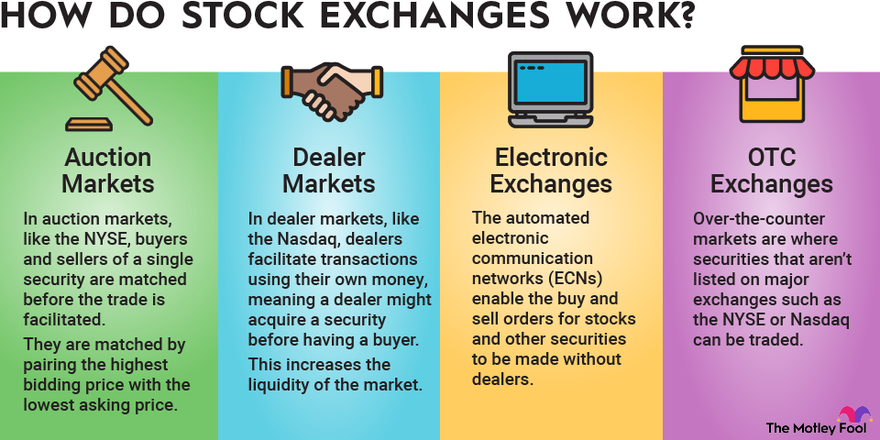

Understanding the Mechanics of Online Trading Exchanges

In the ever-evolving landscape of financial markets, the mechanics of online trading exchanges play a pivotal duty in forming the dynamics of trading activities. As we browse with the complexities of bid-ask spread dynamics, clearing and negotiation procedures, and the regulative framework controling on the internet trading exchanges, a deeper understanding of these systems ends up being essential.Order Kinds and Execution

Market Liquidity and Deepness

Comprehending market liquidity and deepness is crucial for traders looking for to make enlightened decisions in on the internet trading exchanges. A fluid market has a high quantity of trading task, limited bid-ask spreads, and reduced cost volatility.High liquidity and depth can lead to lower deal prices, reduced cost slippage, and increased trading effectiveness. Understanding market liquidity and deepness is critical for investors to browse online trading exchanges efficiently.

Bid-Ask Spread Characteristics

In the world of on-line trading exchanges, a crucial element complying with market liquidity and deepness is the assessment of Bid-Ask Spread Characteristics. The bid-ask spread stands for the distinction in between the highest possible price a buyer is prepared to pay (quote) and the most affordable rate a vendor is eager to approve (ask) for a certain asset. Understanding this dynamic is essential for traders as it directly affects purchase prices and market performance.Bid-ask spreads can differ based upon aspects such as market volatility, trading quantity, and the possession's liquidity (trading). Tight spreads show a fluid market with a high volume of trades, reducing prices for investors. On the various other hand, larger spreads suggest reduced liquidity and can make it extra tough to carry out trades without impacting rates dramatically

Investors carefully keep track of bid-ask spread dynamics to gauge market sentiment and assess the total health and wellness of the market. A tightening spread might show raising market rate of interest and potentially greater trading volumes, while an expanding spread might signal unpredictability or reduced activity - stock market trading app. By examining bid-ask spread dynamics, investors can make more enlightened choices and navigate the intricacies of online trading exchanges efficiently

Cleaning and Settlement Procedures

The Clearing and Negotiation Processes play a critical function in ensuring the organized and reliable completion of deals within online trading exchanges. Clearing up entails validating the information of a trade, validating the purchaser and seller, and ensuring there suffice funds or safety and securities to fulfill the deal. This action helps alleviate counterparty risk by ensuring that both events meet their responsibilities.Following clearing, the settlement process includes the real transfer of funds or protections in between the parties involved in the trade. This transfer usually occurs a few days after the trade date, referred to as T +2 (profession day plus 2 days) Throughout this time around, the exchange makes certain that the properties are traded appropriately, and the purchase is wrapped up.

Effective cleaning and negotiation procedures are necessary for keeping market stability and financier self-confidence. Delays or errors in these processes can lead to financial losses and interfere with market operations. On the internet trading exchanges prioritize streamlined and secure cleaning and settlement devices to assist in smooth and timely transaction conclusion.

Regulative Framework and Conformity

Conformity with regulatory demands entails various elements, consisting of licensing, reporting, run the risk of monitoring, and investor security actions. Online trading exchanges require to get the necessary licenses to operate legitimately and demonstrate compliance with anti-money laundering (AML) and understand your consumer (KYC) regulations to stop monetary criminal offenses. money trading. Routine reporting to regulatory authorities assists in checking the system's activities and guarantees that it runs within the specified regulatory structure

Conclusion

In conclusion, comprehending the technicians of on-line trading exchanges is important for financiers to browse the intricate globe of economic markets. By grasping order types and execution, market liquidity and depth, bid-ask spread dynamics, clearing and settlement processes, in addition to the governing structure and compliance requirements, people can make educated choices and minimize threats when taking part in online trading. It is essential to stick to recognized protocols and policies to guarantee a protected and smooth trading experience.In the ever-evolving landscape of monetary markets, the auto mechanics of on the internet trading exchanges play an essential function in shaping the dynamics of trading tasks.When it comes to on-line trading exchanges, recognizing various order types and their execution is crucial for effective trading. Recognizing market liquidity and deepness is important for traders to browse on-line trading exchanges successfully.

In the realm of online trading exchanges, a vital aspect adhering to market liquidity and deepness is the evaluation of Bid-Ask Spread Dynamics (wowbit trading exchange). These regulative entities establish standards and policies that online trading exchanges have to comply with to ensure clear and fair trading practices, secure financiers' passions, and preserve market security

Report this wiki page